ICRON Finance and Budget Planning connects financial planning with S&OP and operational execution, ensuring that budgets and forecasts are grounded in real-world demand, supply, capacity, and procurement constraints, leveraging AI-powered decision intelligence.

In complex supply chain environments, financial planning cannot exist in isolation. Budgets and forecasts that are disconnected from operational realities lead to unrealistic targets, frequent revisions, and limited accountability.

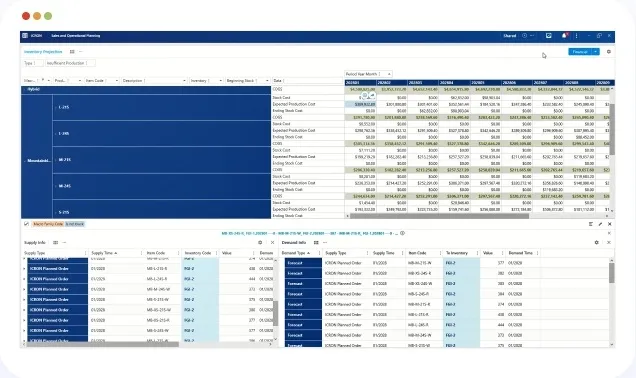

ICRON Finance and Budget Planning provides a unified planning environment where financial plans are directly linked to S&OP, demand, production, capacity, procurement, and inventory planning. This ensures that every budget, forecast, and reforecast is executable, aligned with operational constraints, and responsive to change.

Measurable Business Outcomes

Organizations using ICRON Finance and Budget Planning achieve*:

improvement in alignment between financial plans and S&OP decisions through executable, constraint-aware budgeting

reduction in budget revisions and reforecast cycles using scenario-based financial planning

point improvement in gross and contribution margin through improved cost-to-serve, sourcing, and production decisions

improvement in budget and forecast accuracy by grounding financial plans in operational realities

*Typical outcomes reported by customers. Results vary by industry, constraints, and planning horizon.

Key Capabilities That Power ICRON Finance and Budget Planning

Integrated financial and operational planning

Connect budgets, forecasts, and S&OP plans within a single synchronized model across all planning horizons.

AI-powered scenario analysis and decision intelligence

Use AI-driven analytics to evaluate trade-offs, anticipate risks, and compare alternative financial and operational scenarios.

Constraint-aware budgeting

Align financial plans with real-world production, procurement, capacity, and inventory constraints to ensure executability.

Dynamic cost simulation and budget iteration

Simulate cost drivers, margin risks, and budget assumptions dynamically as demand and supply conditions change.

Capital, strategic, and ESG budgeting

Support CapEx, OpEx, and ESG planning within the same environment while evaluating financial feasibility alongside operational impact.

Real-time margin and cost visibility

Monitor margin at the SKU, product line, or business unit level. Pinpoint high-cost areas and optimize sourcing and production strategies accordingly

End-to-end financial visibility with dynamic global pegging

Link financial outcomes dynamically to demand, resources, and execution across global supply chain networks.

Who Uses ICRON Finance and Budget Planning

Finance leaders aligning budgets with S&OP and operational constraints

CFOs and controllers improving forecast accuracy and enabling agile reforecasting

Supply chain planners evaluating the financial impact of sourcing, production, and fulfillment decisions

Business unit leaders planning margin and profitability targets based on dynamic operational inputs

Strategy and investment teams modeling long-term CapEx, OpEx, and business scenarios

How ICRON Finance and Budget Planning Drives Results

Financial Plans Grounded in S&OP

Ensure that budgets and forecasts are directly informed by executable S&OP plans and operational constraints.

Agile Reforecasting and Cost Contro

Respond quickly to demand shifts, cost changes, and disruptions with continuous reforecasting.

AI-Driven Scenario-Based Decisions

Evaluate multiple financial and operational scenarios using AI-powered analytics to select the best course of action.

End-to-End Financial Transparency

Maintain a clear line of sight across procurement, production, inventory, and fulfillment to improve margin and cost performance.